By: John Krajsa

AFC Reverse Mortgage

The last few weeks we have pointed out that periodic cost, not dollar cost, is the appropriate measure of the cost of a loan and that it is impossible to evaluate loan cost looking at dollar cost alone. Truth in Lending Act (TILA) loan cost estimates such as the Annual Percentage Rate (APR) are not perfect, but since 1968 have been the starting point for and by many are considered the gold standard in loan cost analysis. TILA disclosures use periodic cost in that they estimate the true cost of a loan expressed as an annual rate. For reverse mortgages the primary TILA disclosure is the Total Annual Loan Cost or “TALC” disclosure. Unlike the APR, which estimates the cost at one point in time, TALC disclosures estimate the cost of a reverse mortgage at various points in time.

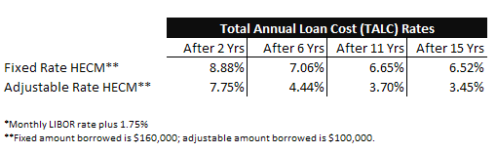

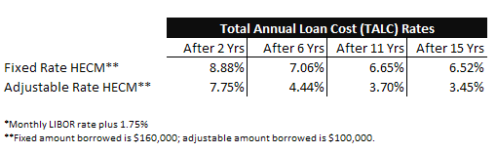

Here are abbreviated TALC rate estimates as of June 17, 2010, for a Home Equity Conversion Mortgage (HECM) with youngest borrower age 76 and a home appraised at $250,000.

Available Fixed Rate Loan Amount $160,000

(Fixed Interest Rate 5.49%)

Available Adjustable Rate Loan Amount $152,522

(Initial Interest Rate 2.10%*)

The above numbers tell us that the estimated annual cost of the fixed rate HECM would be 8.88% after two years, but would drop to 6.52% after 15 years. The estimated annual cost of the adjustable rate HECM would be 7.75% after two years, but would drop to 3.45% after 15 years, based on current rates.

The fixed rate TALC numbers are actual, since the full amount is borrowed at closing and the rate is fixed. The adjustable rate TALC numbers are based on the current rate of 2.1%, and the actual long-term adjustable rate cost may be higher or lower than estimated due to rate adjustments and additional amounts borrowed.

The above TALC rates include ALL costs, such as financed closing costs (about $12,000 for the adjustable and about $8,000 for the fixed), FHA insurance premiums and monthly service fees, and of course, interest.

We should also note that the 5.49% fixed rate is not a 15 year or 30 year rate; it is a lifetime rate. The Annual Percentage Rate (APR) for the fixed rate version of the above loan is 6.47%.

The above TILA cost estimates, in our view, do not support the view that all HECM loans are expensive, but rather estimate the true cost of the above HECM to be very reasonable and to be lowest when used for its intended purpose, as a long-term solution.

Read Full Post »